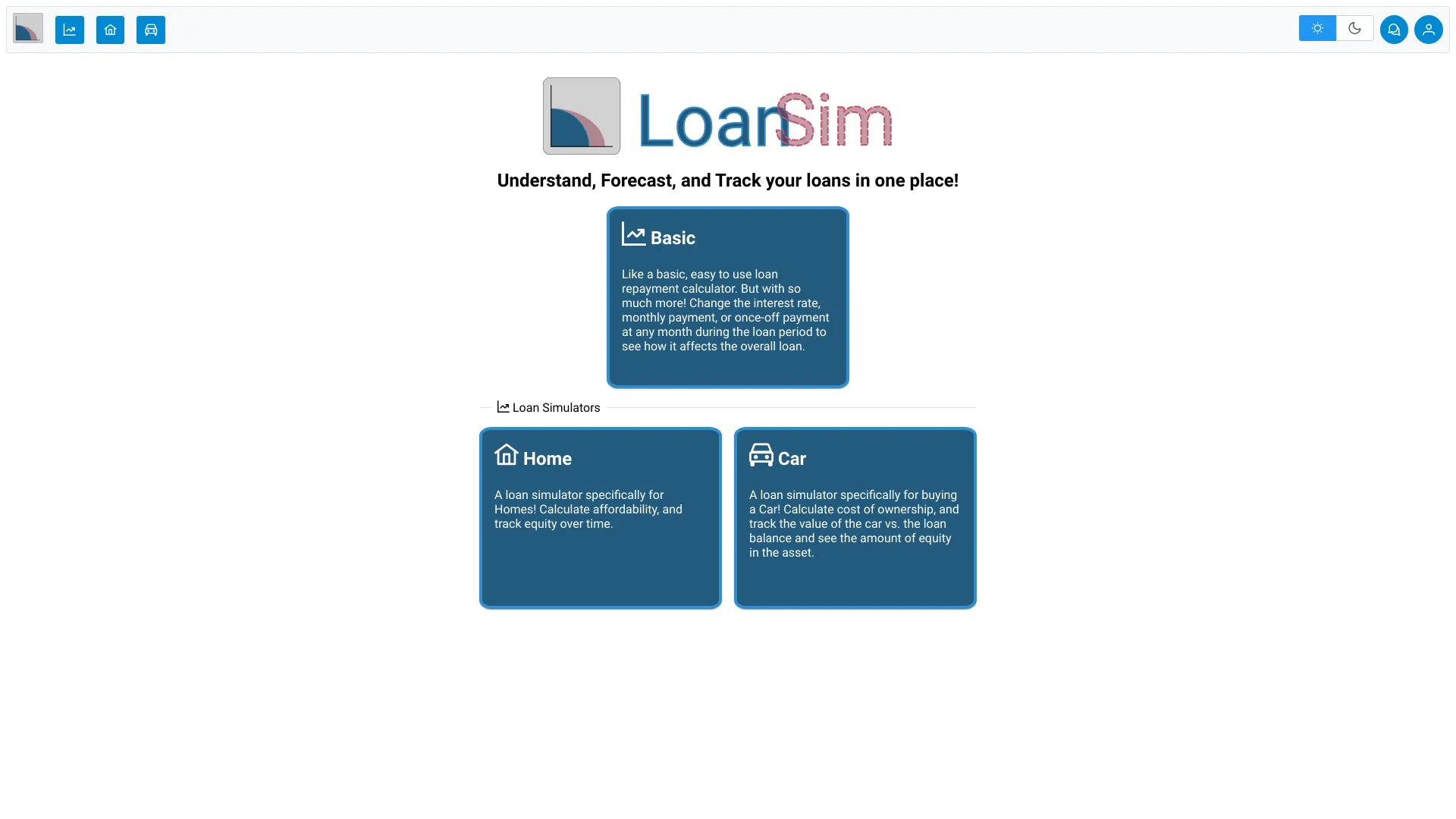

What is LoanSim?

LoanSim is a comprehensive loan management application designed to help individuals and businesses track, forecast, and understand their loans with ease. This powerful financial tool offers flexible repayment options to optimize your financial health, featuring an intuitive interface that allows simultaneous management of multiple loans. Whether you're planning your budget, assessing financial risk, or seeking personalized financial insights, LoanSim simplifies the loan management process, ensuring you stay on top of your financial obligations efficiently.

How to use LoanSim?

Using LoanSim is straightforward and intuitive. First, input your loan details including principal amount, interest rate, and repayment schedule. The application will generate a detailed overview with amortization schedules and repayment plans. You can then adjust parameters to simulate different scenarios and see how various repayment options impact your finances. With just a few clicks, you can explore multiple what-if scenarios and make informed decisions about your loan management strategy.

Core features of LoanSim?

- Multi-Loan Management: Track and monitor all your loans in one centralized dashboard, with real-time updates on payment status and outstanding balances.

- Advanced Forecasting: Utilize predictive analytics to forecast future payments and understand long-term financial implications of your loan portfolio.

- Customizable Repayment Plans: Tailor repayment schedules to your financial situation, with options to reduce interest payments or accelerate loan payoff.

- Budget Integration: Seamlessly integrate loan management with your overall budget planning for comprehensive financial oversight.

- Risk Assessment Tools: Evaluate potential risks and opportunities in your loan portfolio with built-in analytical features.