What is Insurance Policy AI?

Insurance Policy AI is a sophisticated software solution designed to simplify complex insurance documents and bridge the gap between insurance jargon and user understanding. This innovative tool empowers both individuals and insurance professionals to navigate policy details with confidence, preventing coverage gaps and ensuring comprehensive understanding of insurance terms. By leveraging artificial intelligence, it transforms confusing policy language into clear, actionable insights, making insurance management transparent and reliable for all users.

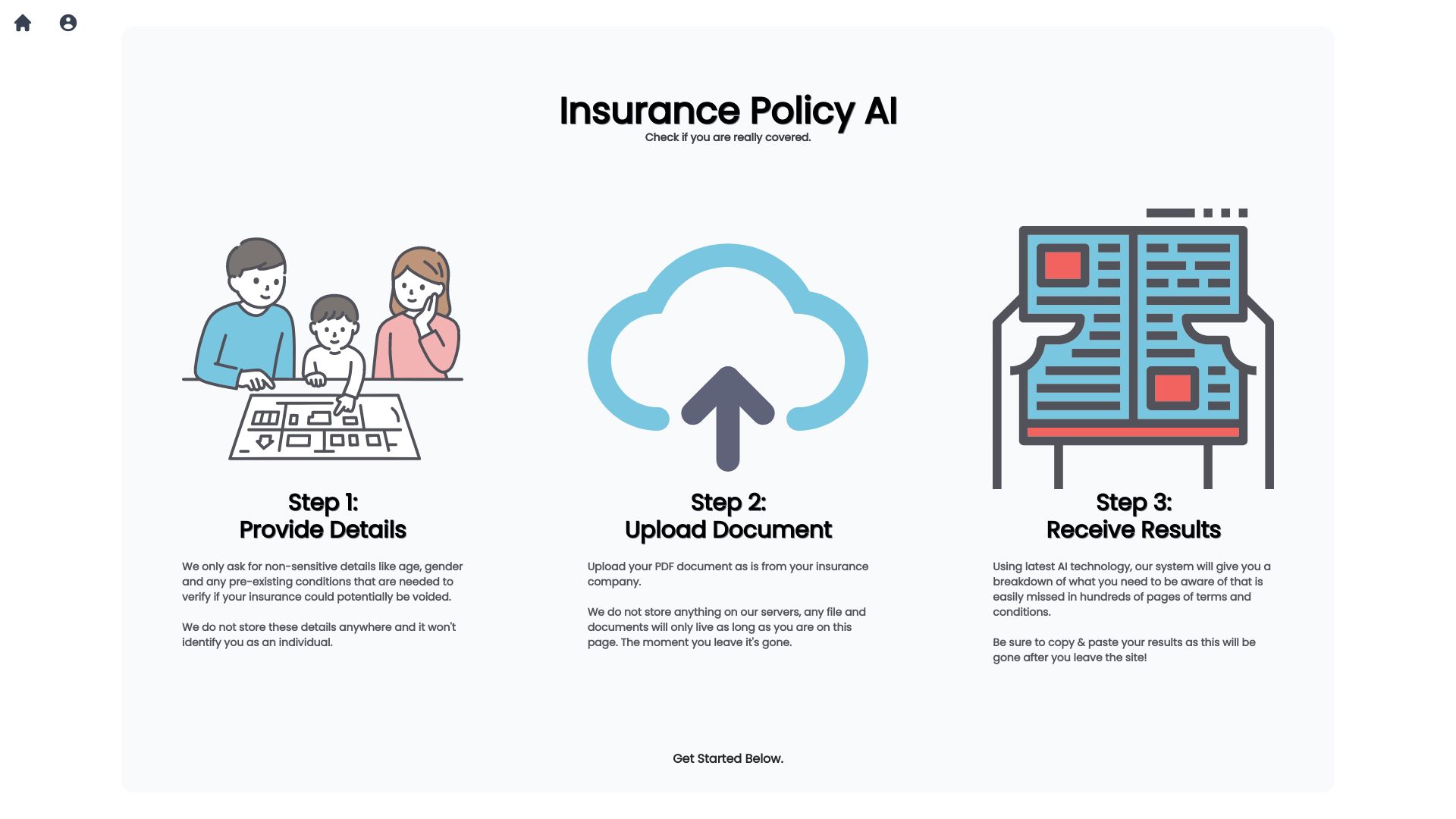

How to use Insurance Policy AI?

Using Insurance Policy AI is straightforward and efficient. First, users upload their insurance policy documents through the secure platform. The AI immediately begins analyzing the text, breaking down complex clauses and highlighting critical information. The system identifies potential loopholes, ambiguous language, and coverage gaps while providing personalized recommendations for policy optimization. Users receive a comprehensive report with clear explanations and actionable suggestions, enabling informed decision-making about their insurance coverage.

Core features of Insurance Policy AI?

- Real-time Policy Analysis: Instantly processes and interprets insurance documents with AI-powered accuracy

- Loophole Detection: Automatically identifies coverage gaps and ambiguous clauses that could lead to claim denials

- Personalized Recommendations: Provides tailored suggestions for policy enhancements based on individual needs

- Comprehensive Coverage Mapping: Visualizes policy benefits and limitations for easy comparison

- User-friendly Interface: Intuitive design accessible to both insurance professionals and everyday policyholders